Asset Tokenization: How Blockchain Improves Real-World Assets Ownership

Asset tokenization using blockchain technology allows real-world assets to be converted into digital tokens to make them more secure.

Asset tokenization has become popular in recent months. It uses blockchain technology to allow the purchase of real-world assets like artwork and real estate and translate them into tokens.

This method leads to the generation of fresh investment strategies, reduces the possibility of fraud, and boosts liquidity, which makes it useful for the finance sector.

What Is Asset Tokenization?

Asset tokenization is the process of taking physical assets and creating immutable digital tokens on a blockchain that represent ownership of that asset. Such tokens make it possible to purchase, own, and trade a fraction of an expensive asset like art, real estate, or publicly traded company shares.

For instance, one can buy an ownership interest in a house by buying the digital representation tokens of interest rather than paying for the whole house. The property is secured through blockchain technology, and transactions are automated by smart contracts to ensure security and transparency.

Key Benefits of Asset Tokenization

Liquidity

Increased liquidity is one of the main benefits of asset tokenization. Real estate and other traditional assets are frequently illiquid, making them difficult or impossible to sell.

This is resolved by tokenization, which enables such assets to be split up and converted into a range of tradable tokens that can be exchanged across various blockchain-based platforms.

Fractional Ownership

Anyone can invest in one asset as long as they purchase the token representing their ownership. Thus, there’s an opportunity to own several assets without having to invest in each physically.

Therefore, it is always possible to invest in assets or high-value items that are not easy to acquire due to their high cost.

Transparency and Security

This technology makes the account and any assets owned secure by decentralizing and distributing information concerning the history of transactions and all changes in ownership or control over objects on the blockchain.

This transparency reduces the risk of fraud or misrepresentation of the asset’s authenticity, especially in the fine art or luxury goods market, where the value heavily depends on authenticity.

Reduced Transaction Costs

Blockchain can be instrumental in eradicating transaction costs associated with a practice common in most business transactions, which requires middlemen like brokers and lawyers. The presence of automation increases efficiency as many of the legal and financial steps are embedded within those smart contracts, allowing the deal to be completed in a short time and at lower costs.

Tokenization Examples

Several large institutions are in the advanced stages of considering tokenization. Visa, Deutsche Bank, and JPMorgan are examples of such institutions. Visa has launched the Visa Tokenized Asset Platform (VTAP), which lets banks create and distribute digital assets, including stablecoins and central bank digital currency (CBDC).

The others focus on tokenizing money market funds (MMFs) and real estate assets. JPMorgan’s Tokenized Collateral Network (TCN) lets its clients tokenize shares of MMFs to make them useful as collateral for their various instruments.

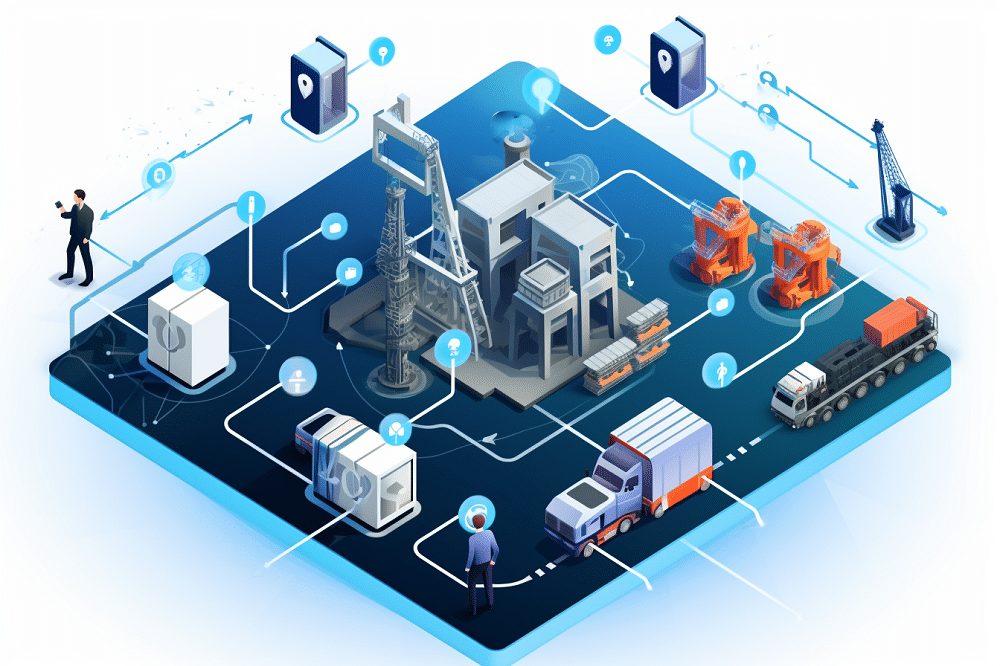

How Does Asset Tokenization Work?

Here is the step-by-step guide to asset tokenization:

Ownership of the property

A legal verification process is essential so that the pertinent asset can be tokenized freely and without any legal issues.

Migration of Ownership to Blockchain

Most tokenized assets go through the Ethereum or Solana blockchain due to their established ecosystems and faster transaction rates.

Asset Valuation

Experts and markets are often called upon to pronounce the value of the asset. This value indicates how many tokens can be issued and at what price.

Token Issuance

Lastly, the asset gets split into a number of tokens that are transferrable and tradeable on exchanges based on blockchain technology. Automated processes for the purchase, sales, and movement of these tokens are provided and executed via smart contracts.

Technical Stacks

The infrastructure supporting the asset is tokens, which are on the blockchain. Ethereum supports the default ERC-20 and ERC-721 tokens; Solana has SPL tokens, which have higher transaction speeds and lower costs.

Oracles also hold great importance in this context. They provide reliable and real-time data to ensure that the purpose and ownership of the assets are fulfilled. For instance, oracles could obtain price information from solicitors or stock exchanges to support or dispute the values of the assets being tokenized.

Difficulties in Asset Tokenization

Tokenized assets have numerous advantages. However, they have a few disadvantages.

Regulatory Uncertainty

A number of countries do not have clear regulatory frameworks around tokenized assets. This uncertainty creates risks for issuers and shareholders because their tokenized assets could attract legal action and regulatory risks.

Smart Contract Vulnerabilities

While the blockchain is secure, smart contracts, the code that undertakes the transactions over the assets, may contain bugs or even be poorly written. Tokenized assets could be at risk, as a contract that is assumed to be secure can fail due to exploitation.

Weak Oracles

Oracles are the go-betweens that relay off-chain information to on-chain smart contracts. If they’re weak, they introduce vulnerabilities to the entire tokenized ecosystem.

If a network’s oracles’ data is tampered with or wrong, the whole tokenization process is meaningless.

Conclusion

The tokenization of assets through the use of blockchain technology has a good future. Tokenization is slowly becoming the norm with the introduction of platforms like Visa’s VTAP.

With time, there will be a future where shares in luxury cars, real estate, and even stocks and bonds will be represented by digital tokens. Hence, the possibilities for development and advancements within this field remain vast.

However, there’s a need to have some structure in place, especially regulations that govern these processes and the industry.