Intro to CFD Share Trading Strategies

CFD Share Trading

The business of CFD share trading on the financial markets deals in volatility because a host of factors pull the strings behind an asset’s prices, both on a long-term and a short-term basis. Financial traders are focussed on the job of using all the available information – world news, market news, and financial data – to ascertain in which direction an instrument’s prices are due to head. In the case of traditional share trading, the culmination of all this lies in buying shares that are expected to increase in value, or alternatively buying crypto currency that is set to appreciate. CFD trading, however, is different. Through CFD trading, it is possible to invest in the price movements of financial instruments of all kinds – shares of big companies like CocaCola, Pfizer, or Tesla, and also crypto currencies, commodities, ETFs, indices and currency pairs – but without ever owning the asset.

Instead of agreeing to buy, for example, $10,000 of Apple shares, a CFD trader can open a $10,000 “buy” deal on Apple shares (if he believes the shares are due to appreciate in the short-term). Since he never means to actually own any company shares at all, he could equally open a $10,000 “sell” deal on different shares he believes are about to decrease in value. CFD share trading is done with higher leverage than regular trading, which will allow our trader to open a $10,000 deal without having to come up with all that money. If he used leverage of 20:1, he need only put down $500 to open the deal; the rest would be lent to him by his broker (contingent on having enough available margin in his account). Leverage, however, cuts both ways and the ability to magnify one’s trading power also applies to losses.

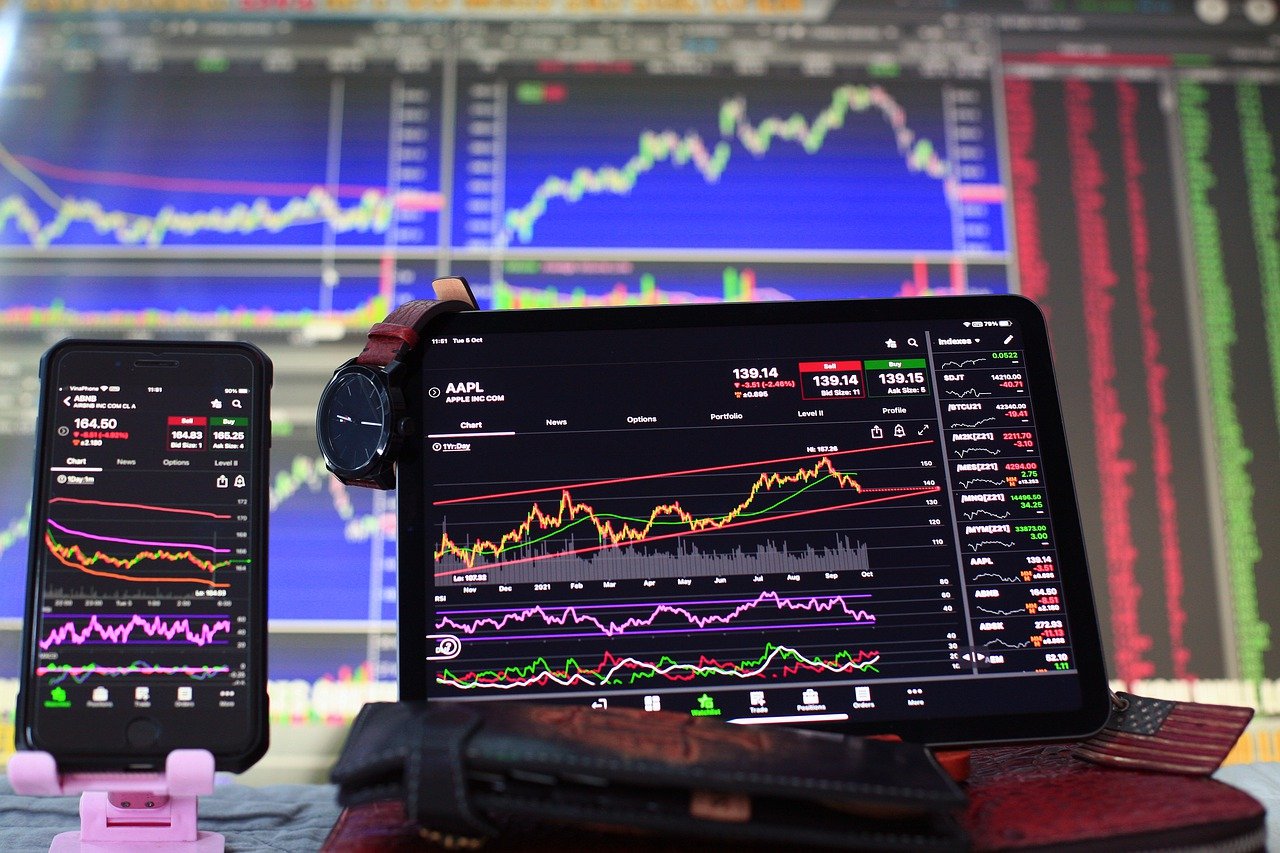

The high leverage offered keeps traders interested in CFDs, but so does the straightforward access to all the world’s financial markets on an easy-to-use mobile platform. CFD traders know, though, that succeeding is not easy. It takes know-how, experience, and diligence to become a grounded, skilled CFD trader. The two chief ways traders develop their strategies are called fundamental analysis and technical analysis, and both are techniques by which the CFD trader tries to take a helicopter ride over traffic to see where the going will be smooth and where it might be blocked up.

Fundamental Analysis – Think of fundamental analysis is studying the most obvious, superficial elements that could affect the price of an instrument. For example, the news, a financial blog, or items on a broker’s economic calendar. A CFD trader using this method will research the management of the company in question, look at its earnings history, and examine its balance sheets. He’s interested in figuring out if this company is a well-oiled machine with all elements needed to keep growing into the future. The short-term behaviour of trading instruments can be quite fickle, though, and therefore not reflect the deep fundamentals behind the company scenes.

This is why fundamental analysis is more suited to long-term trading than short-term trading. Take as an example a trader who finds out that soybean stocks are overflowing from last year, and that the plantings this year are set to yield huge amounts as well. This analysis gives him valuable insight into soybean supply, which plays a dominant role in determining prices and which could affect his decision to open a “buy” or “sell” CFD deal. The same can apply to share trading: having a good idea where a company is headed financially can lead to a shrewder approach to trading.

Technical Analysis – Think of technical analysis as looking at the medical history of an instrument to get a clearer idea of how it’s performed in the past and using that information to speculate how it might behave in the future, based on a set of criteria. One such set of criteria or share trading strategy is known as MACD (Moving Average Convergence Divergence) lines, which can help a know if a bullish trend is building and about to break out, or if a bearish drop is around the corner. Let’s say a CFD trader knows that a certain stock has been pushing bullishly up for many weeks; then it pauses, evening out. If he sees the MACD line cross above the signal line, he has a signal that the bullish trend is about to continue, and he uses the opportunity to open a “buy” deal. Conversely, when the MACD line crosses below the signal line, it indicates a bearish trend may be about to break out.

Wrapping Up

When it comes to share trading strategies, both fundamental and technical approaches can help you form a well-rounded attitude that can lead to more informed trading decisions. There is a lot more to understand about both of these categories, so read up as much as possible and watch video tutorials showing real technical analysis at work. Ultimately, the aim is to incorporate each of them into your overall trading strategy in a measure that fits your particular goals and experience.