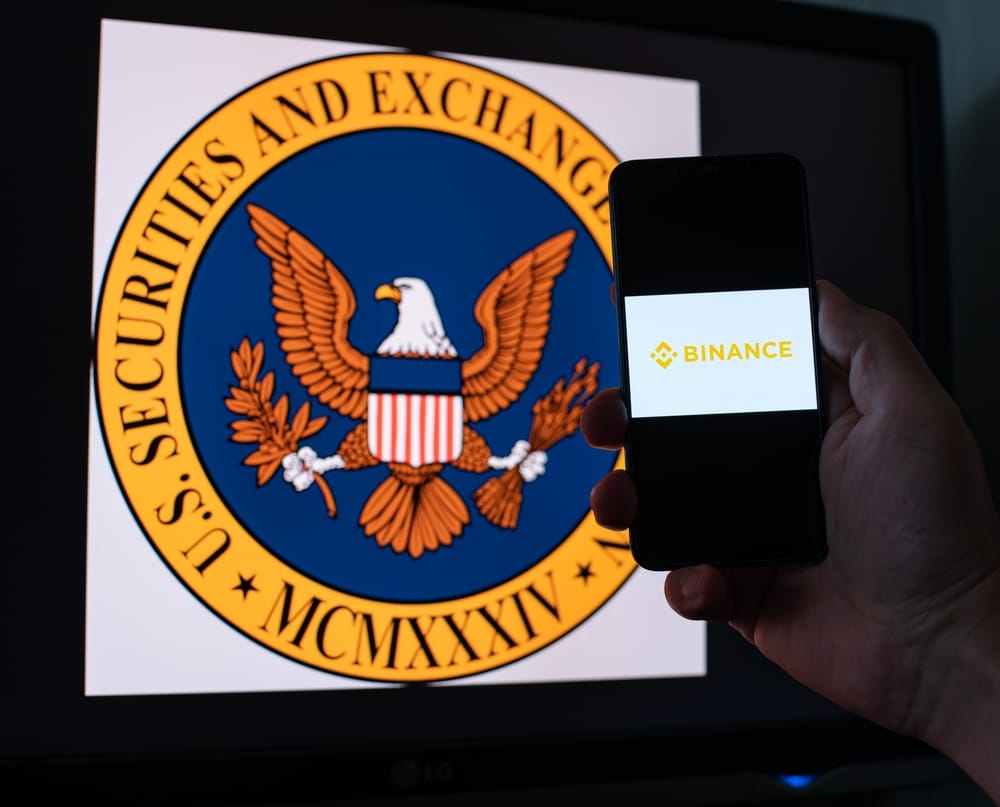

SEC Classifies Cardano, Solana, and Polygon as Securities When Charging Binance

In its Monday statement, the Securities and Exchange Commission (SEC) confirmed charging Binance with 13 counts of violating the US securities laws. The high-profile lawsuit initiated on Monday, June 5 statement on Monday opened a lawsuit against Binance and chief executive Changpeng Zhao.

Binance and Affiliated Entities Cited as Respondents in Lawsuit by SEC

The charges sheet identifies Binance, Zhao, BAM Trading, and BAM Management as the defendants. SEC alleges the defendants openly disregarded the federal securities laws by violating the safeguards the laws provide to the investors and market operators. In its Monday filing to the District of Columbia Court, the securities watchdog accuses the defendants of enriching themselves using billions of dollars in earnings from US investors who undertook the vulnerable assets.

SEC alleges that Binance’s chief executive oversaw the commingling of clients’ funds to evade the guardrails established by the securities laws. The Gary Gensler-led SEC accuses Binance of erecting sham controls to determine the parties to conduct business with the firm.

Gaming and Top Ranked Tokens Plunge as SEC’s Opens Charges Against Binance

The high-profile suit by SEC saw the lead gaming tokens, including AXS, MANA, and SAND, classified as securities. Speculators consider the move signaling that SEC has several altcoins within its radar, including Solana, Cardano, and Polygon. The altcoins considered as securities have the leading crypto market capitalization of several billion, with others propelling gaming-centered projects.

The lawsuit, as revealed by Bloomberg publication, indicates that the digital asset platform, alongside its executive Zhao, broke the US securities laws. The filing identifies Zhao as the Binance founder as the defendant, citing the influence he yields as the controlling shareholder.

SEC charges identify Binance’s wrongdoing in offering unregistered offers. Also, the platform offered a sale platform for cryptos it identifies as securities. The filing accuses Binance of failing to prevent US investors from accessing the Binance platform.

Solana Leads Polygon and Algorand in the Marketwide Tumble

Besides Solana and Cardano, Binance’s lawsuit leaves multiple coins classified as securities. BNB token and BUSD stablecoin were identified as securities alongside Polygon, Filecoin, and COTI. SEC filing featured an expansive list of cryptos it considers securities, including Algorand, Cosmos Hub, Decentraland, Axie Infinity, and The Sandbox.

Market outlook just after the SEC announced the enforcement action saw several tokens plunge. Solana suffered the hardest hit, with the token tumbling 6% to exchange hands at $20.14.

Further scrutiny showed Alogrand was not exempt from the plunge, with the token declining by 9.9% to $0.13. The CoinGecko data shows Alogrand declined despite the positive profile that SEC’s Gary Gensler offered in the past.

Since the news of the lawsuit broke, Polygon and Polkadot suffered a decline, with the price levels eroding by 7% and 6.9%, respectively.

The SEC alleges that Binance and the BAM Trading entity that operates Binance.US operated the exchange without fulfilling the requisite qualifications. Although the US operations are often portrayed as running independently, SEC accuses Zhao and BAM Trading of offering exchange services in the country without registration. Besides, Binance operated as a broker-dealer and clearing agency without the SEC’s approval.

SEC attorney alleges that Binance international exchange and Binance.US offered unregistered cryptos as securities. Failure to register violated the procedural guideline in the securities laws.

It accuses the two of depriving investors of access to material information, particularly trends and risks, with the potential to affect enterprise operations and investment within the securities.

Editorial credit: Artsaba Family / Shutterstock.com