Bitcoin’s Low Transaction Volume Suggests an Upward Move

Bitcoin currently has fewer transactions than it did a few months ago. This suggests that the price of Bitcoin is likely to be on the move soon. Bitcoin’s transaction volume is still down from December, and sentiment, in general, seems to be bearish. That’s usually a sign that the market is ready for a rally. The lower the number of Bitcoin transactions, the more likely that sentiment will swing in favor of higher prices.

In July 2021, the price of Bitcoin dropped below $6,000 for the first time since May. It is now up more than 70% from that low, currently selling at $50,000. Despite the massive BTC price move, the analysis still points out that transaction volumes are low.

Bitcoin hit its lowest transaction volume in years

Since the beginning of the year, the number of transactions in Bitcoin has gone down, but the value of those transactions has increased significantly. According to a Glassnode research, on-chain activity for Bitcoin did not increase in response to the higher price levels. Just 180,000 transactions, on average, have been processed in the last 24 hours. This is a new record low. During the bull market of 2016 to 2017, the low levels have been seen during the pullback. Afterward, Bitcoin dropped 85% from its peak during the bear market of 2018 to 2019.

With downward momentum, transaction volumes are down after three months of consolidation. The Bitcoin network is recording $18.8 billion of daily transactions, which is lower than the records in May. Now that Bitcoin has finished consolidating, the daily transaction volume is 57% lower than before the last pullback in May.

Bitcoin is not the only digital asset experiencing significant gains; no other cryptocurrencies are experiencing similar gains. Compared with other cryptocurrencies, Bitcoin has not performed well in trading volume during its move to $50,000.

Bitcoin price is predicted to rise soon

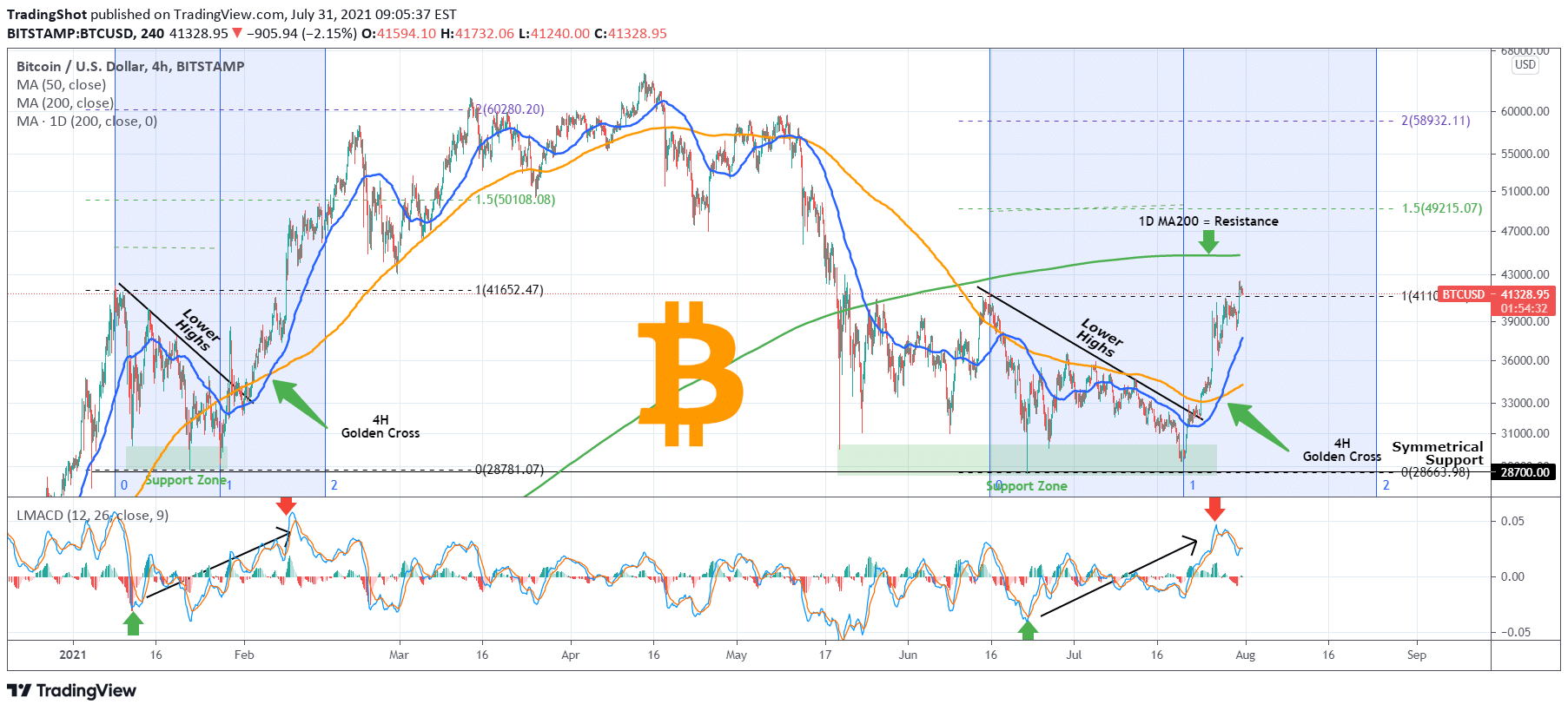

The price of Bitcoin is on an upward trend. Most of the time, there is a slight fluctuation before a significant rise in the price. The Bitcoin price rose above $50,000 on August 23; it recorded a 61.8% Fibonacci extension level. However, after testing $50,000, it is likely to stutter before it makes another move.

BTC/USD Price chart. Source:TradingView

The Arms Index (TRIN) measures the relationship between the average range of the BTC and its market capitalization, and it’s an indicator of the amount of volatility that you can expect for a particular cryptocurrency such as this. This is signaling a lot of buying volume in the Bitcoin market, and that overall, more people are buying the leading cryptocurrency than selling it.

Bitcoin must break above a resistance line at $51,529 to indicate buyers are in control. A surge could then push Bitcoin towards the 78.6% Fibonacci extension level, which currently reads around $57,000. If the data is right, then it means that BTC investors were getting more anxious on the bearish side as Bitcoin price neared its yearly high.